Currencies

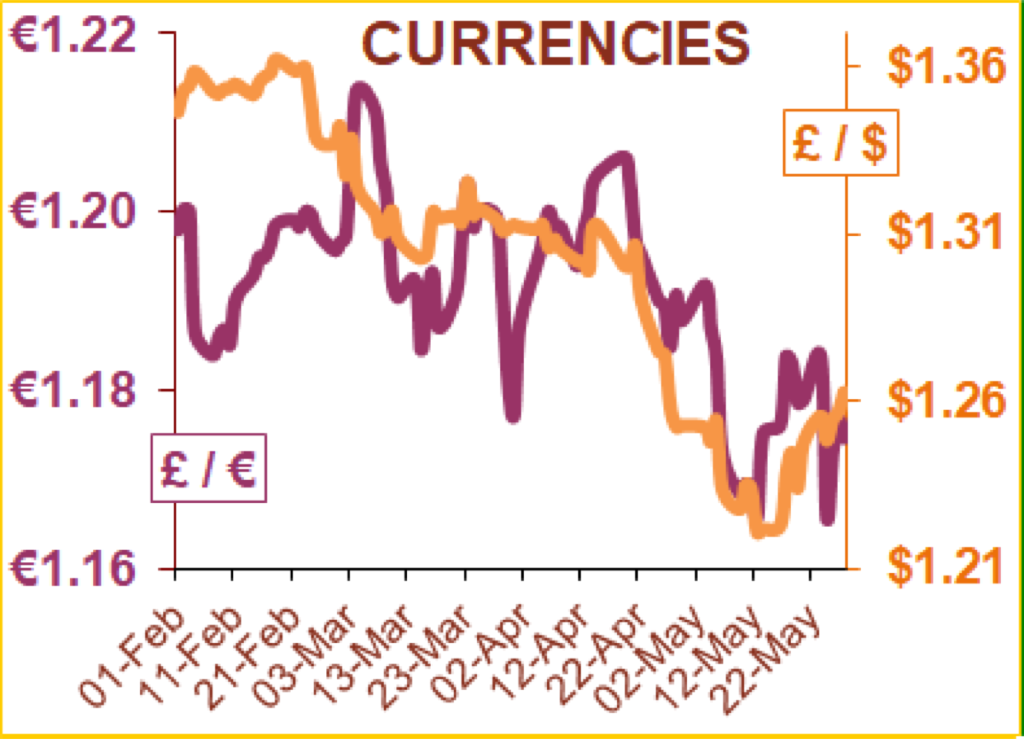

Currency has seen a slightly better week, lifted in part following Rushi Sunak’s cost of living package announcement on Thursday.

Long term though, the sentiment against the £ is still bearish with impasse over the Northern Ireland protocol and a continued ‘hawkish’ tone from the Bank of England, (using interest rates to keep inflation in check).

The question continues to be if we can do enough to keep the country falling into a full on recession.

Wheat

The wheat market has been on a continued downward trend for the first time since the middle of April this week, although we have reached prices of over £360 on November futures in that time so down is not necessarily meaning good value still!

There was some degree of profit taking once markets hit their historic highs with the sentiment that a bull market needs more news to keep its momentum that was not coming through.

This week we have also seen reversals on the Indian export ban, with the country now committing to 1.8 MlnT of grain for export, more than they have ever done previously. We also saw an example of the ‘war premiums’ built into this market with news that the UN were negotiating safe passage for wheat shipments from Ukraine to the rest of the world triggering a move down £9 on Liffe.

Looking at the weather, the US are still experiencing crop downgrades and the widespread rain across Europe this past week unfortunately appears to be too little too late. Having said that, for the UK at least, it appears to have come at exactly the right time although there are varying reports about the levels of nitrogen which have been applied this season which would cause questions around yield potential.

Soya

Soya is becoming an old crop/new crop story now. There is more pressure on US old crop material to plug the gap left from the smaller South American harvest which is beginning to push the summer values up again from their recent moves lower.

Soya Bean hit their highest ever value on Chicago, which is obviously even more expensive once filtered through our weak currency.

For the winter though, the US have had an ideal window for planting and given that the price of soya vs corn was already in favour of soya, we should see some good early indications on volume.

Sunflower markets continue to look difficult with more reliance on the much smaller Argentinian crop now although there has been reports of volume still making its way across borders out of Ukraine, but this won’t be in anywhere near normal traded volume.

Organic

We are beginning to see offers for both grains and protein for new crop (October/November onwards time), and although the price is extremely high, the material is available which means we will see consistency in our diets.

And Finally…

Is nothing sacred?

Winnie the Pooh, AA Milne’s famous creation, for his son Christopher is loved by children – of all ages, is to have another outing in film. In his various incarnations, he has delighted people for over 100 years, not least in the various Disney films:

So what idiot wants to blight his memory with a horror film?

A director called Rhys Frake-Waterfield is desecrating the image of the beloved bear by bringing him back with a vengeance in an upcoming movie called `Winnie the Pooh: Blood and Honey.’ The horror film is an independent film and is not to be confused with Disney's jolly, honey-guzzling version of the yellow bear.

Who could possibly be confused when the horror pooh looks like this:

Do not take your children to see this!

What ever would piglet and Eeyore think of this?

Regards,

Kay Johnson & Martin Humphrey