The currency continues to have a significant effect in this volatile time. Stirling values remain low after falling for over a month due to political instability both from Brexit and internal political unrest. However some support is being seen against the dollar.

November UK wheat price ended last week at £151.5/T. The wheat market has traded within a narrow range over the last month, but generally has traded lower. The US market, and in particular its weather issues, continue to overshadow any UK market news. The volumes traded are currently low in the UK, Europe and US.

In the UK trades have been made for both the end of old crop and new. Old crop prices have dipped as oversupply in the Midlands and East Anglia has meant that grain has had to travel further than usual to find a market, but not untypical for this pre-harvest season. Harvest is close, and it may take news from the first of this year’s crop to give the UK market some direction.

The wheat crop development in both the UK and Europe continue to be positive and FrenceAgriMer rated French soft wheat as unchanged at 80% good/excellent, 5% ahead of last year at this stage. The current predictions for the French wheat crop are to be 40 Mln T, which should mean less maize imports this season, when compared to the last season.

The US weather remains the key driver for agricultural commodity markets, and Midwest has had the wettest 12 months on record, and despite improving forecasts, weather remains the primary focus. The June USDA acreage report showed planned acres of maize 3 million above the average trade estimate, and after jumping $14 up, the market dropped $25 almost instantly as the trade reacted – a sure sign that the current weather market is volatile! US wheat acres and stocks were also above trade estimates in the USDA report. The US wheat market followed maize trading down $24 although a small rebound was seen shortly after. Some in the trade fear these figures could have been worse if the large stock of soya beans in the US had not put many off a move to planting more soya resulting in an extension to the maize planting period this year.

Russia has adjusted its wheat crop slightly downward due to recent heat but the crop continues to look to reach near record harvested levels. State weather forecasters report the heat has not affected the spring wheat areas too much. With this in mind if European crops do meet expected levels, it will be interesting to see how the wheat price is affected in our UK markets if we wish to remain competitive on the export market to remove our surplus.

The global grains markets are stuck between the difficult year the US has and the ongoing trade war with China. Weather woes, and the promise of strong yields globally for the next season would suggest that markets will remain volatile.

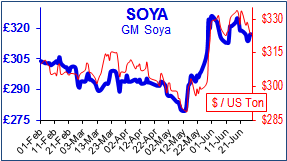

The soya bean complex has seen support and gains over the last two weeks but is currently lacking a firm direction as the trade wait further G20 news to break. As Friday neared and the G-20 results grew nearer open interests in both US Soya bean and grains dropped. Before the report, funds had been buyers for the soya complex as it came away from the recent highs and sellers of wheat and maize. Maize prices have been strongly supported creating a price run over the last month due to weather woes in the US and this has started to move into the Soya markets.

The USDA downgrade estimates for both soya acreage and yield to reflect planting delays. The trade have felt these adjustments were overdue, but with planting later than for maize and with the trade already supporting maize the focus is moved to soya beans. We await the facts to emerge from the G20 summit meeting (rather than the razzmatazz) where President Donald Trump and Chinas Xi Jinping are in talks. News that China bought 544 Mln T of 2018/19 soya beans from the US was taken by the trade as a goodwill gesture rather than an end to the trade war. A resolution to the long standing trade dispute between the countries would dramatically affect trading flow patterns and market values with China still world’s number one importer of soya beans.

As warm weather raises the temperature, many are keen to get a cooling ice cream to beat the heat. For many children there is no better sound than the ice cream van. But in New York the streets are silent as investigators have seized nearly 50 ice cream trucks after their owners were accused of avoiding paying over £3.55 million in fines!

Operation meltdown targeted the frosty criminals for thousands of violations from running red lights and parking blocking fire hydrants and pedestrian crossings. Between 2009 and 2017 22,000 tickets have been ignored by Dimitrios Tsirkos, the biggest offender by dissolving his business and re-registering the vehicles under new companies.

But this is not the first `less than sweet’ story for this ice cream tyrant as he is already in a long standing dispute with Mister Softee who in 2013 claim he opened a business with the same name and near identical logo. A court ruled against Mr Tsirkos in 2016 to end what investigators called a `mafia turf war’ over the sweetest spots in the Big Apple.

It turns out it is not just the ice cream that is cold in the dog eat dog ice-cream world. Stay safe Mr Whippy!

Brought to you by Melanie Blake and Martin Humphrey.