After starting the month at already contract highs of £163/T UK November wheat futures are currently trading at £187/T, after touching £190/T.

Feed compounders are being forced to take unexpected cover with the ruminant industry forced into summer feeding due the effects of the heat wave on grazing. This is pressuring the price up to a level not seen since 2013. Sellers are hard to find of both old and new crop as the combination of the small predicted crop size and rising prices looks to promise more to those holding the grain. With the first samples of wheat being tested as harvest starts (a little earlier than normal) results indicate that yields are varied and quality in the south at least seems good so far, but what will the recent rain have done to it? The demand for milling wheat in the EU is high, so there is good potential for export unless the premium is too low for arable farmers selling the wheat. After last year’s short supply, and the north south divide for supply and demand in the UK, the industry seems more prepared this year.

The wheat market appears to be tracking the European market, albeit at a premium for imports at this early stage of the harvest year. Some UK regions are already importing, so it is expected that the UK may become a significant importer in the 2018/19 season.

The UK market continues to be linked to the EU and US market. With significant decreases in the expected size of wheat and barley crops reported in the EU and black sea regions, the availability of total world grains is estimated to be 2059 Mln T for 2018/19, but could drop further if harvest yields continue to disappoint. Global grain consumption is increasing by 1% year on year, yet supply and production is down 2% year on year, so supply will tighten and prices have more upside than downside.

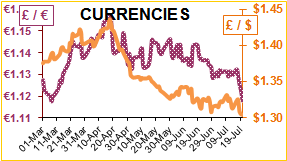

China’s wheat production is down 20 Mln T, which will add further pressure on international wheat prices. The trade dispute does appear to be continuing between the US and China, despite some promising progress reported on the tariffs between the US and Europe/Mexico, US prices still have a heavy influence to these events. The EU and UK seems to have focussed back on supply, demand and currency as the main market drivers. With the £ showing a small recovery bounce against the € to €1.125 and no real change against the $, this is more the effect of no news. With reports due from the bank of England on interest rate and Brexit updates continuing with growing urgency that could both have a significant impact.

Trade in Europe for US soya was strong this week lifting prices, but not enough to fill the hole left by reduced trade with China as a result of the trade wars. Having previously purchased all non US soya bean they could source as at least 20 Chinese soya processing mills, including two of its largest, have cut or suspended output. Record stocks of soya bean meal and a year long slump in demand from Chinese pig farmers have allowed this. China’s National Development and reform Commission, have called on the feed producers to discuss reducing soya bean meal use and sourcing alternative protein rich ingredients. With Brazil hoping to gain a 5 Mln T export quota to sell soya bean meal and soya oil to China, the change in the supply chain are starting to show, as this material would likely have been destined for Europe prior to the tariffs between China and the US.

A Scottish river was the location for the discovery of Britain’s largest recorded gold nugget. Weighing almost 85.7g it has been named the “Douglas Nugget” and valued at around £50,000.

The amateur prospector who found it 2 years ago using a process called sniping where you lay face down in the water with a snorkel sifting the riverbed has only just come forward.

The location of the find is being kept secret to prevent a gold rush. But it is likely that this is not going to make the finder rich, as the nugget is likely to be handed over to the Crown Estate, classed as “Mines Royal”. A law that means most gold and silver discovered in the UK belongs to the crown. It looks like the finder will have to make do with spending just the finders fee.