Last Friday, November wheat futures were trading at £160/T, and then touched a low of £154.25/T on Tuesday before closing at £159/T on Friday.

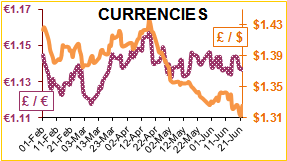

Prices for this November contract have averaged at about £150/T, so are higher due to global weather concerns and due to a lack of physical supply on the spot market. The UK market continues to follow the European markets where on-going dry conditions in northern Europe and the Black Sea continue to cause concern. Conversely, in France it has been so wet for so long that they need hot dry weather in order for the combines to get in the fields. The old adage that ‘rain makes grain’ will be tested shortly. UK farmers are concerned about the impact of recent dryness on spring crops; the England forage report indicates that grass is not growing due to lack of moisture (confirmed by the fact that I did not have to mow the lawn this weekend). The winter wheat looks very healthy indeed, and the spring barley is nearing harvest. Currency and trade wars continue to be make for volatile markets with a low £ and strong $ making imports expensive.

Both global crop production and consumption of maize, wheat and soya are near record highs, and this year consumption is expected to exceed production on all three crops. This means that global stocks will be reduced this year, and that the world is very sensitive to any news that might mean a reduction in production. The Argentine loss of 17mt of soya is ‘old news’ but has tightened the protein market. The poor weather in the Black Sea is mainly responsible for the fact that there will also be 17Mln T less wheat produced this year, compared to last year.

It would seem that the funds have been worried by the talk of trade wars and possibly by the USDA report later this week. The latest fund report is for the 19th June, thus in the four weeks prior to this, the funds have sold 2Mln T wheat, 27Mln T maize, 17Mln T soya and 3Mln T soya bean meal. Thus soya and maize prices have crashed, so soya bean meal which was $380/short ton on the 1st June, closed at about $335/short ton last week. The crash slowed at the end of last week flattening to a low of £327 ex UK port. The US funds are concerned that the US may not have a willing outlet for its agricultural exports. The situation is confused: there is a reduced Chinese demand for soya; US farmers appear to be planting less soya and maize; Chinese farmers are planting more soya; yet world soya supply and demand are tighter than previous years. Although current political holds on markets are currently driving prices down, it should be expected that at some point, the requirement to consume soya will take the prices higher. The Organic world depends on China to supply organic soya; there is a possibility that the Chinese government could curtail soya exports for its own use.

Given the plethora of TV coverage of a certain sporting event, you may have missed the fact that this weekend England hosted the world egg throwing championships.

Numerous events with team entries from around the globe for events such as: target throwing, with maximum 3 points for a groin shot; and the Egg Russian roulette championship.

In the main event teams of two stand increasingly further apart and attempt play catch with raw eggs without it being dropped or broken.

Time to find a partner and get practicing for next year... first decision is who is the official catcher, and who is the tosser?

Read more here: http://swatonvintageday.com/egg-throwing/