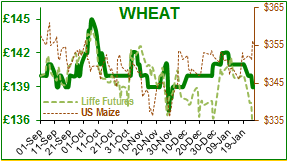

May UK wheat futures have been range-bound between £140-£143/t since November last year, but weakened this week and fell through to £138 on Friday, the lowest price since December 2016.

The Matif May wheat contract had been about €4/t higher than UK wheat for most of December at €164/t, but now both UK and French wheat are almost at parity at €158/t. French and US wheat (and US maize) have lifted from their recent lows, and the US market is trading about $4-5/t up on the week; so it seems that the weakening of the $ and strengthening of the £ (£1/$1.43), is pressurising Liffe and Matif wheat lower. The strength of the sterling is now at levels not seen since before the Brexit vote. Donald Trump said on Thursday that he wants the dollar to be strong, contradicting statements made by his Treasury Secretary Steven Mnuchin the previous day. In an interview with CNBC, Trump said that Mnuchin's comments had been misinterpreted (not fake news then?).

Within the UK, the wheat North-South divide in supply and demand continues, so that physical prices are being supported by the higher demand areas in the North, which results in little opportunity for wheat exports from Europe. EU shipment data shows a drop of approximately 17% on last year’s export pace. The EU Commission lowered the UK’s wheat production from 15.1mt to 14.62 (DEFRA 14.84mt), which is more in line with trade estimates, therefore reducing the 17/18 EU soft wheat production forecast to 142.6mt. Depending on how analysts construct the UK wheat S&D, then the UK export surplus probably falls to just over 0.5mt, assuming that the UK also imports 1.6mt. There are more challenges concerning logistics this year than in any previous year that we remember, including:

- the availability of haulage to move the quantity of wheat required in the North from the South for the rest of this year

- the lack of export movement through UK ports which must be limiting the income of the larger grain companies.

Russia seems to have realised that it has little competition in the international wheat export market this year, and its wheat export prices have been rising, not least because the Rouble is at near 9 month highs. But this does not seem to have reached a level that will affect Russia dominance in the export markets so far. Currently Algeria Jordan, Japan and South Korea are tendering for wheat.

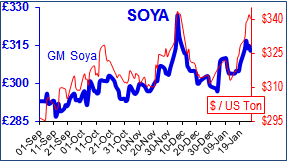

Following eight successive ‘up’ days, peaking at midweek, the soya complex finished the week below peak; soya beans (March contract) balked at the $10/bushel barrier; soya bean meal (March contract) tried to hit $350/short ton but failed, trading at $338/short ton on Friday. Currency also seems to be a main driving force in this story, but so do the funds. The funds have increased their soya short from 12.6mt on 9th January to 14mt by the 16th January, but reduced their holding of soya bean meal from 1.4mt to 0.7mt. There were differing estimates of the Argentine soyabean planting area this week with BAGE maintaining the 18Mha estimate and the Ag Ministry reporting 16.8Mha. Both reported planting at approximately 95% complete, and that dryness is likely to prevent 100% from being achieved. Brazil’s share of the China’s imports reached a record level in 2017 at 55% of their total, while the US was only 34.5% its lowest level since 2006. Brazil has several competitive edges: high protein values, competitive pricing and fewer weed seeds. These trends look to continue this year. China’s imports of soyabean for December were up 6.1% from the same period last year 9.55 million tonnes, with an annual demand estimated to be 96mt this year.

The remains of the Clotilda - the last known ship to carry enslaved Africans into the US may have been found. The Act Prohibiting Importation of Slaves was enacted in 1807, but slavery itself was only abolished in the US in 1865 by the 13th Amendment. In 1860 an Alabama plantation owner bought a two-masted schooner and engaged Captain William Foster to smuggle 100 slaves from Benin. The slaves were transferred to a riverboat and the Clotilda was burned.