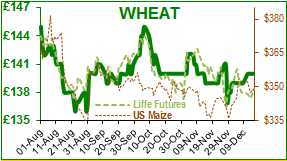

UK May wheat futures have traded in a 50p band from Monday-Thursday this week from £141.50 to £142.00/t, hovering just above the post-harvest low of £140.0/t. The Matif May wheat futures were similarly prostrate, trading between €163.50-€165.00/T.

US March wheat futures are also moribund trading at $4.20/bushel a few cents above the contract low of $4.10/bushel. So all wheat markets are weak, reflecting ample global stocks and pressured by forecasts of larger Canadian and Australian harvests. Brazil and Argentina are also currently busy harvesting, so the world is not short of wheat. Russia’s share of the wheat export market was about 1% in the year 2000, and is about 18% this year, as the world’s largest exporter. Over the same period US wheat exports have almost halved, and US farmers have planted fewer acres as a result. Global strategists are concerned that much of the world is now dependent on Russia for its staple foodstuffs, and that many of their major export destinations are political hot-spots (Nigeria, Sudan, Yemen, Turkey, Indonesia etc). Strategie Grain have forecast that EU wheat exports for 2017/18 will be 22.3mt (24.1mt last year) as Russian wheat dominates world markets. Up to December 9th, the EU had exported 9Mln T of soft wheat (12.1Mln T at the same time last year), which is a fall of 25%, which if extrapolated for the year would mean only 18Mln T of wheat exports rather than the 22.3Mln T estimate above. The French AgriMer reduced its forecast for French 2017/18 wheat exports outside the EU to 9.5Mln T, but analysts believe that this is still too optimistic. Strategie Grains also believe that the EU soft wheat crop next year will be 142.3Mln T (142.4Mln T this year). The funds are about 16Mln T short of wheat (short = sold in expectation of the market falling further – but they could be wrong! ) and have been for the past six weeks; they have also been about 20Mln T short of maize for the past nine weeks.

Maize is continuing to trend lower and is arguably bouncing on the bottom, as value is difficult to find in a market where supply is greater than demand. The converse of this argument is that US maize is export competitive but prices have not lifted sufficiently to correct the down trend, as maize exports are only at around 34mb (60Mln bushels last year). The USDA increased the estimate for US ethanol use but this could yet be balanced out by a further increase in the final US production estimate.

Soya finished the week lower at 10 week contract lows at about $9.7/bushel. Soya bean meal January futures peaked at $348/short ton in the first week of December and has retreated to $321/short ton. Argentinean weather reports are still variable with rain forecast but La Niña usually means dry crops, so traders are wary. The Argentine soya bean planting was reported at 65% complete this week, which is about normal.

Of the 350Mln T of global soya that will be produced this year, some 152Mln T will be exported, of which the US will export 61Mln T and Brazil 66Mln T. Chinese demand for soya is expected to reach 97Mln T, and the EU is in second position with a lowly demand of 14Mln T.

Brazilian senators recently passed a bill proposing large increases in biofuel use such as ethanol and biodiesel in coming years, which has the potential to change current supply dynamics.

Despite some uncertainty due to Brexit negotiations and signs that the UK economy may be slightly slowing this week Sterling has remained stable. The US Federal Reserve raised interest rates for the third time this year causing the dollar to fall against major currencies.

In 1474, the magistrates of Basel sentenced a cock to be burned at the stake for the ‘heinous and unnatural crime of laying an egg’. When incubated by a toad, the yolkless ‘oeuf coquatri’ was thought to produce a cockatrice or basilisk (two-legged dragon with a rooster’s head) which would hide in the roof and with its ‘death-darting eye’ would destroy all the inhabitants. This belief remained intact from the 12th to the late 18th century; in 1710 La Peyronie, surgeon to King Louis XV, was compelled to write a paper proving that cocks are incapable of laying eggs.